Bankruptcy Services

Bankruptcy & Non-Bankruptcy Services

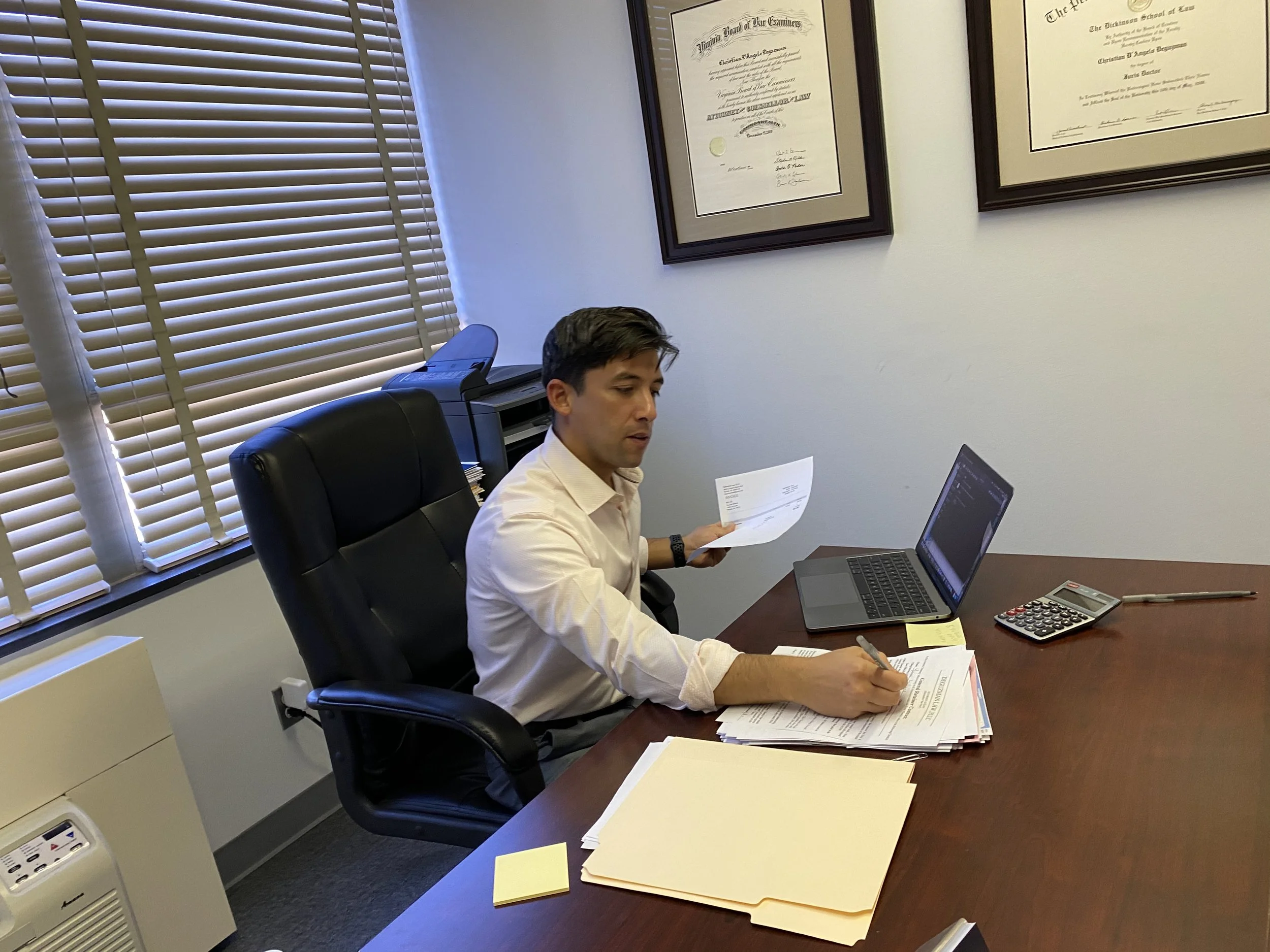

As the managing attorney of DeGuzman Law, Christian D. DeGuzman understands that dealing with debt and creditor collection efforts can be very stressful. For over a fifteen years, Attorney DeGuzman has dedicated his practice to helping clients overcome debt. Whether you are facing a foreclosure or repossession, a judgment, garnishment, bank levy, harassing phone calls from a creditor or collection agency, a tax lien, whether you are past-due on child support or spousal support, or whether you simply want to improve your credit with a “fresh start”, DeGuzman Law’s debt relief and bankruptcy legal clinic will provide you with tailor-made solutions designed to address your specific financial problem.

The following is a comprehensive list of DeGuzman Law’s services, which include but are not limited to:

Chapter 7 Full/Liquidation Bankruptcy

Chapter 13 Reorganizations/Debt Restructuring

Non-Bankruptcy Debt Settlement

Non-Bankruptcy Debt Payment/Consolidation Plans

Foreclosure Defense

Repossession Defense

Short Sales Negotiation

Mortgage Loan Modification Assistance

Credit Report Repair

Attorney DeGuzman also specializes in resolving Internal Revenue Service (IRS) tax debt and tax liens, state tax liability, personal property taxes and bridge/toll violations. If you owe the IRS, call us now.

*Contrary to popular belief, many debts owed to federal, state and local government agencies are dischargeable in bankruptcy. These include but are not limited to: Social Security Administration (SSA) benefit overpayments, unemployment benefit overpayments (VEC), Bridge/Tunnel Tolls Violations, etc.

*Also, while some income tax debt owed to the IRS or state tax entity are non-dischargeable in bankruptcy, there are exceptions to this general rule. If you owe the IRS, call DeGuzman Law today at (757) 333-7336 or fill out the short intake form below for a FREE consultation.